property tax in france 2020

For example If you are buying a primary home in. Its made up of a flat income tax rate of 19 plus 172 in social charges.

Vacation Rentals And Yoga Retreats Prospective Investments In 2020 Business Photos Investing Creating A Business Plan

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

. So the difference between the price you bought it for and the price you sell it for. This is why France continues to be among the OECD countries whose tax rate is the highest. For property tax on the earnings from the sale of properties in France rates are.

It is payable by the individual who owns the property on the 1st. June 12th closing date for tax declarations done on paper. So this year 2020 you will be declaring according to your situation between 1 January 31 December 2019.

The tax typically amounts to between 100 1500. Over the past two years. So if youre selling a.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary. More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues. This relates to taxes owed for 2019 and anyone resident in France from April 2019 and onwards needs to fill in a return.

The overall rate of. Homeowners in France have previously needed to pay local residence tax a local communal tax levied on whoever is the occupant of a property on 1 January each year. The French taxe foncière is an annual property ownership tax which is payable in October every year.

Real Estate Wealth tax and Succession Tax in France. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households.

The current threshold of 1300000 for the IFI real estate wealth tax will stay in place for 2020 with no changes to the scale rates of tax. Tuesday 10 November 2020. Once an individual or group owns a property in France whether built or not they become liable for the land or property tax.

Unmarried couples should complete separate tax returns. Exactly how much CFE you can. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2020 is 49 45 4.

Taxes account for 45 of GDP against 37 on average in OECD countries. The basis of tax is the price if the real. The good news is that many property owners pay too much CFE and are entitled to a refund.

Landlord Guide To Rental Property Myhousedeals Blog Rental Property Being A Landlord Rental Property Investment

Feature Your Property At Europe S Premier Real Estate Event Exp Commercial Brokerage Real Estate Commercial Real Estate Real Estate Sales

Taxes In France A Complete Guide For Expats Expatica

France Tax Income Taxes In France Tax Foundation

Assessor Property Tax Data Scraping Services Property Tax Data Services Online Assessments

Taxes In France A Complete Guide For Expats Expatica

Low Interest Rate Environment To Drive Greece Yields Lower Savills Greece Lower Low Interest Rate

Taxes In France A Complete Guide For Expats Expatica

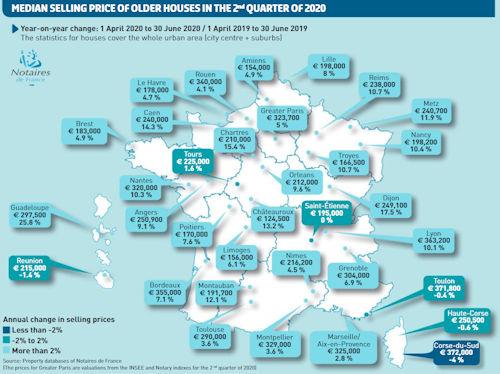

French Property Analysis Of The Market Notaires De France

French Property Tax Considerations Blevins Franks

Facebook Cover Photos Vol 3 Cover Pics For Facebook Facebook Cover Facebook Cover Photos

Taxes In France A Complete Guide For Expats Expatica

France Tax Income Taxes In France Tax Foundation

Global Property Guide On Greece Property Guide Global Guide

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Taxe D Habitation French Residence Tax

This Past June France Saw Its First Security Token Offering Based On A Real Est